Predicting intention to buy real estate for investment in Da Lat city, Vietnam, with an extended theory of planned behavior

- An Giang University, VNU-HCM

- University of Technology, VNU-HCM

Abstract

This study aimed to predict the intention to buy real estate for investment. It was guided by the Theory of planned behavior (TPB) and Financial Management Behavior View (FMBV). Apart from 6 in-depth interviews, a total of 253 questionnaires were completed by respondents in Da Lat City, Lam Dong Province. By mixing both quantitative and qualitative research and data, the breadth and depth of understanding about real estate buying behavior were gained, and hypotheses were tested. The results show that the extended TPB, which includes customers’ attitudes, subjective norms, perceived behavior control, and financial satisfaction, is a good model for predicting the willingness to buy real estate for investment. As a result, planned behavior and financial satisfaction played a role in the intention to buy real estate for investment in Da Lat city, Vietnam. Managerial implications were also grasped: real estate companies might pay attention to the attitude of their customers, finding out who could influence the customers’ decision-making in a real estate context, helping their customers have better understanding while buying real estate; customers’ financial satisfaction is also considerable while dealing with real estate customers.

Introduction

The drive for this research is threefold-fold. First, Vietnam is now becoming one of the luxury property market hotspots. The World Bank in Vietnam1 reveals that Vietnam has a booming economy with economic growth of 7.1% in 2018, after expansions of 6.8% in 2017 and 6.2% in 2016, and is considered one of the most dynamic emerging countries in East Asia. Foreigners easily own real-estate property in Vietnam with new laws, e.g., the Housing Law and Law on Real Estate Business (effective July 1, 2015), the law on Sell and Transfer of Real Properties, which was subsequently fleshed out by Decree No 99 (effective on December 10, 2015) and by Circular 19 (effective August 2016). The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) effective on January 14, 2019, is expected to attract more wealthy international investors, who are looking for real estate investment opportunities in Vietnam2. In addition, Vietnam’s urbanization rate reached 38% in 2018, an increase of 0.9% compared to 2017. The increase in urbanization in 2018 caused the real estate and construction materials markets to achieve considerable growth. According to Deputy Minister of Construction Le Quang Hung, approximately 50% of Vietnam's population will live in urban areas by the 1940s. Mr. Hung also added that the Ministry of Construction will focus on interconnection with other regional markets in 20193.

Second, real estate purchasing could be investigated from a behavioral perspective rather than from a utilitarian perspective. Real estate purchasers were said to make rational purchasing decisions from available information. Theoretically, real estate evaluation is said to depend on the physical characteristics of real estate, such as location4 and public services5. However, the inclusion of consumer behavior concepts would benefit the study of real estate6. In fact, behavioral research could help to understand housing purchases7. As a result, the real estate market must be explored as a behavioral science8. This study applies the Theory of Planned Behavior, explaining the real estate buying intention for investment.

Third, integrating buyer’s financial satisfaction would improve understanding of individual decision-making behavior in the context of real estate. Income positively influences financial satisfaction9, 10, financial decision making 11 and preparation for financial emergencies10. There is a relationship between financial satisfaction and the ability to make investment decisions12. This study investigates the effect of financial satisfaction on real estate buying intention for investment, extending the Theory of Planned Behavior.

This study can provide crucial insight for real estate investors because there are very few research papers investigating the behaviors of real estate investors in Vietnam. Earlier studies in Vietnam (e.g., 13, 14, 15) explored real estate purchasing from a utilitarian perspective, while behaviors were impacted by preceding mental information processing6. This paper, therefore, explains real estate purchasing behaviors by investigating the behaviors influencing buyers’ intentions.

Literature review and hypothesis development

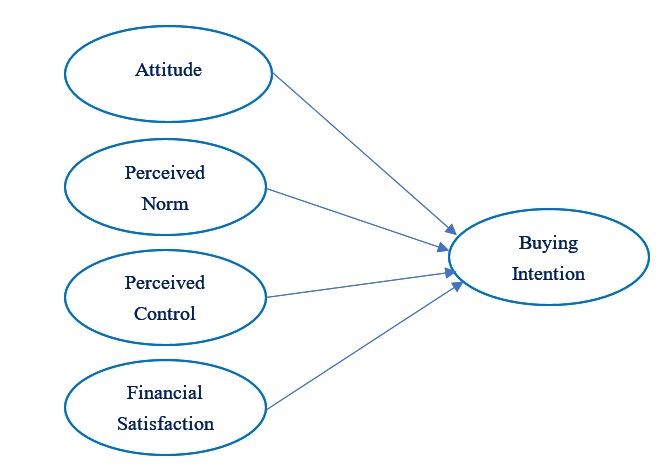

Combining the Theory of Planned Behavior (TPB) and the Financial Management View (FMV), this study considers four factors that influence real estate buying intention for investment. The first three factors include attitude, perceived norm and perceived control from the perspective of TPB. The fourth factor is financial satisfaction with FMV.

The TPB holds that intention to perform the behavior is the most important determinant of behavior in the integrated behavioral model, along with the four factors that directly affect behavior, i.e., environmental constraint preventing performance, salience of the behavior, knowledge and skills to perform the behavior, and habit16.

The literature on TPB indicates that attitude, perceived norm and perceived control positively affect customers’ intention to purchase17. This theory has been applied in a number of contexts, e.g., online grocery shopping18, halal food purchasing19, and organic product purchasing20. Attitude toward consumers’ behavior is defined as the overall favorableness or unfavorableness toward their purchasing behavior. Perceived norm is regarded as social pressure on the performance of a particular behavior. Perceived control is consumers’ perceived degree of control over behavioral performance. Consumers’ buying intention would likely be determined by these three factors. Three hypotheses are proposed as follows:

H1: The more positive the attitude toward real estate investment is, the greater consumers’ purchase intention toward real estate investment.

H2: The more positive the perceived norm of real estate investment, the greater the consumers’ purchase intention of real estate for investment.

H3: The more positive the perceived control of real estate investment is, the greater consumers’ purchase intention of real estate for investment.

Behavioral Model of Real estate Buying Intention for Investment

In addition to the three determinants, from a financial management perspective, those who are more satisfied with their finances will be more likely to make investment decisions. Real estate prices continue to increase, which is attractive to those who can afford to buy real estate for investment. Based on neoclassical economics, previous studies on real estate showed that consumers are expected to maximize their wealth6. However, families could face financial difficulties because of personal risks such as illness, property losses, and death10. One, therefore, tends to invest more money in real estate when he feels confident about his financial status, apart from support from his family members. Therefore, it is rational to consider financial satisfaction as one of the determinants of real estate buying intention.

Figure 1 shows the behavioral model of real estate buying intention. The proposed hypothesis will be

H4: The more customers feel satisfied with their financial status, the greater their purchase intention of real estate for investment.

Methodology

This is a two-stage study. First, 6 in-depth interviews were conducted. The interviews were conducted to seek initial support for the research model, especially financial satisfaction as a newly added factor in comparison with previous studies about real estate buying intention (e.g. 21, 22). These qualitative data were also used to modify the research instrument and to enrich the quantitative results.

The main quantitative research was performed with more than 300 questionnaires distributed to respondents, and 253 completed questionnaires were used for analysis. Selected randomly, the sample of this study included people living in Da Lat City, Lam Dong Province, aged between 18 and 55 years. The questionnaire was adapted from various studies 17, 21, 23. The Statistical Package for Social Science (SPSS) version 21 was applied to analyze the data profile and to test the hypotheses.

The goodness of the measures was confirmed by factor analysis and reliability 24. Explanatory factor analysis (EFA) was conducted based on the suggestion of Hair, Black24 using the varimax rotation method, the Kaiser–Meyer–Olkin (KMO) test in Bartlett’s test, and Cronbach’s alpha value.

The demographic information of respondents was analyzed with descriptive statistics (see

Result

Initial support of the research model in Figure 1 was found in the qualitative research. Interviewees showed that their attitude toward real estate investment is associated with their purchase intention. Family members have a considerable effect on customers’ intention to buy real estate for investment. Those who received more support from the family would invest more in real estate. Additionally, there is a positive relationship between the perceived control of real estate investment and customers’ buying intention. Importantly, qualitative data indicated that customers who are more satisfied with their family finances feel more confident and have more intention to buy real estate to obtain higher income. These qualitative results support the use of the research model in the next quantitative study.

Survey respondents’ profile

|

Respondent profile |

Category |

Frequency |

Percentage |

|

Gender |

Male |

140 |

55.3 |

|

Female |

113 |

44.7 | |

|

Age |

18-25 |

21 |

8.3 |

|

26-35 |

60 |

23.7 | |

|

36-45 |

120 |

47.4 | |

|

46-55 |

52 |

20.6 | |

|

Income |

Less than VND 10 million |

71 |

28.1 |

|

VND 10 to 20 million |

100 |

39.5 | |

|

More than VND 20 million |

82 |

32.4 | |

|

Marital status |

Single |

95 |

37.5 |

|

Married |

158 |

62.5 | |

|

Extended family |

Yes |

95 |

37.5 |

|

No |

158 |

62.5 | |

|

Total |

253 |

The goodness of the measures and sampling adequacy were ensured, as presented in

Reliability and Exploratory factor analysis

|

Variable |

Loading |

Eigen value |

Variance |

Reliability Cronbach’s alpha |

|

Financial satisfaction |

6.518 |

34.305 |

0.802 | |

|

TMTC7 |

0.766 | |||

|

TMTC4 |

0.729 | |||

|

TMTC6 |

0.703 | |||

|

TMTC3 |

0.698 | |||

|

TMTC5 |

0.633 | |||

|

TMTC1 |

0.589 | |||

|

Perceived Control |

1.854 |

9.758 |

0.848 | |

|

NTKS4 |

0.787 | |||

|

NTKS6 |

0.733 | |||

|

NTKS2 |

0.715 | |||

|

NTKS5 |

0.705 | |||

|

NTKS1 |

0.644 | |||

|

Perceived norm |

1.722 |

9.061 |

0.842 | |

|

CCQ4 |

0.814 | |||

|

CCQ3 |

0.787 | |||

|

CCQ1 |

0.774 | |||

|

CCQ2 |

0.747 | |||

|

Attitude |

1.469 |

7.73 |

0.834 | |

|

TD3 |

0.793 | |||

|

TD1 |

0.775 | |||

|

TD2 |

0.767 | |||

|

TD4 |

0.688 |

Results of the regression

|

Variables |

Standardized Coefficients Beta |

Sig. |

|

Attitude |

0.462 |

0.000 |

|

Perceived norm |

0.114 |

0.009 |

|

Financial satisfaction |

0.296 |

0.000 |

|

Perceived Control |

0.168 |

0.000 |

|

R2 |

0.664 | |

|

Adjusted R2 |

0.659 | |

|

F |

122.576 | |

|

Significant |

0.000 |

Regression analyses were performed to confirm the relationship between the independent variables and dependent variables. The results show that R square = 66,4%; this means that approximately 66,4% of the variation of the dependent variable was explained by the independent variables jointly. F value =122.576, and p = 0.000 confirm the adequation of the model. All four hypotheses were confirmed.

Discussion & Conclusion

This study explains real estate purchases by investigating the behavior influencing buyers’ intentions. The combination of the Theory of Planned Behaviors and Financial Management Behavior View enriches the literature on buying behavior and decision making for personal/family investment. The variation of the dependent variable can be explained more by the four factors jointly in comparison with previous studies that used three factors of the Theory of Planned Behaviors, ., those of Al-Nahdi, Ghazzawi 22, and Al-Nahdi, Habib 21. As suggested by Gibler and Nelson6, the use of consumer behavior concepts in traditional real estate studies could improve the understanding of individual decision-making, leading to better explanations and predictions in real estate markets and, as a result, greater success in the marketplace.

The TPB was extended in various contexts, and this study included financial satisfaction in the standard model in the context of real estate purchases for investment. Hansen18 found that personal values influenced consumers’ attitudes toward online grocery buying and that this relation may be moderated by consumers’ online purchases in the past. Group norms and self-esteem were added to the standard TPB variables to predict intentions to use social networking sites frequently25. The inclusion of perceived value in an extended TPB model is fruitful, increasing the variance in continuance participation intention and participation behavior over the standard TPB constructs26. Risk perceptions, anticipated regret, benefits and habits were included in the standard TPB for further analysis of the personal protective equipment use of UK riders 27. Maloney, Lee20 found that perceived expensiveness indirectly influences intention to buy through attitude. In line with the above-cited studies, the extended TPB, which includes peoples' attitudes, perceived norms, perceived control, and financial satisfaction, turned out to be a good model to predict consumers’ willingness to purchase real estate for investment.

Several managerial implications were also grasped. Based on neoclassical economics and the utilitarian perspective, previous studies on real estate buying have investigated available information for investors, and this study confirms the role of planned behavior and financial satisfaction. As a result, real estate companies might pay attention to the attitude of their customers, finding out who could influence the customers’ decision-making in a real estate context, helping their customers have better understanding while buying real estate. This is because this could improve customers’ buying intention. In addition, customers’ financial satisfaction is considerable when dealing with real estate customers.

This study has several limitations. Given that the study was conducted in Da Lat city, a generalization to all real estate customers in Vietnam might not be reached. In other words, the result may not accurately reflect the actual customers’ intention to purchase real estate all over Vietnam. To generalize the findings, further research in many different geographical areas in the country should be conducted.

Competing Interests

The authors declare that they have no competing interests.

Authors' Contributions

Authors significantly contributed to this work, read and approved the final manuscript.

Appendix A

Attitude

Buying real estate for investment is

TD1 Lubricant

TD2 Good idea

TD3 Clever

TD4 Admirable

Subjective Norm. RE (Real Estate)

CCQ1 Think I should invest in RE

CCQ2 Want me to invest in RE

CCQ3 Let me invest in RE

CCQ4 Think it is my wise decision

Perceived behavioral control

You have the following items for making decisions on buying real estate for investment.

NTKS1 Opportunities

NTKS2 Enough time

NTKS3 Enough money

NTKS4 Information

NTKS5 Skills and knowledge

NTKS6 Controllability

Financial satisfaction

TMTC1 Ability to meet needs

TMTC2 No need to purchase assets

TMTC3 Regular savings

TMTC4 Controllable debts

TMTC5 Ability to meet long-term financial goals

TMTC6 Ability to meet financial emergencies

TMTC7 Ability to manage family's finance

Buying intention

YD1 Invest in RE in future

YD2 Plan for investment in RE

YD3 Try to invest in RE

YD4 Want to invest in RE