Research on the Various Forms of Risks in Banking Systems and the Current Regulatory System

- University of London

Abstract

Since banks occupy a central position in the current global financial system, they play a main role in promoting the development of financial markets and even entire economies. Since banks suffer great losses from the risks caused by borrowers’ potential defaults on the loan when they lend to individuals or institutions, credit risk is normally considered to be the main risk type in the daily operations of banks, while other forms of risk are paid slightly less attention or are completely ignored. The banking industry has undergone many significant changes over the decades, which resulted from the reform of its business model, the emergence of advanced technology, and the improvement of laws and regulations. Therefore, the evolving environment eventually leads to many other forms of risk, which may also result in bank failure and even trigger financial contagion and a global financial crisis. This paper will elaborate on various forms of risk facing banks and corresponding management measures and then discuss whether regulators should exclusively consider credit risk. Although I agree with regulators that credit risk has received more attention in the past, I am sure that each financial crisis contributes to improving their views of the financial system and the complex nature of associated risks. This paper also describes the current regulatory system and provides recommendations on how regulators can efficiently regulate, supervise and support the activities of all financial institutions by creating more robust mechanisms for enforcing regulations.

Various Forms of Risks in the Banking System

A variety of methods are available for classifying risks in the banking system, for example, based on risk factors, the extent of influence, and the possible consequences. In this paper, we analyze various forms of risk classified by cause and outline corresponding risk management measures to reduce the probability of occurrence and negative impacts of these risks.

Credit risk

According to BCBS (2005)1, credit risk is defined as the risk that banks will suffer great losses due to the failure of borrowers or counterparties, no matter whether they are individuals or entities, to meet the full contractual obligations when due in the future.

Credit risk is generally seen as the greatest traditional and the most common risk facing banks, as it is highly possible that the loans and other financial products offered by banks cannot be paid off in a timely manner. Thus, credit risk is usually associated with counterparty default.

Credit risk management

Traditional credit management measures are based mainly on qualitative analysis, including investment diversification, avoidance of credit extension concentration, collateral and guarantee requirements, frequent assessments and dynamic monitoring of customers’ creditworthiness, etc. In recent years, advanced modeling techniques and quantitative analytical models have been developed and widely used to predict future credit risks. Additionally, credit rating agencies also play critical roles in credit risk management2.

Market risk

Market risk is defined by Harle (2016)3 as the risk that the bank will experience losses in its trading book due to the unpredictability of factors in the capital markets, including equity prices, interest rates, foreign exchanges, commodity prices, and other market indicators whose values are determined by the open market.

Market risk arises from speculation in the financial market, which leads to a loss once the unfavorable price fluctuations at a particular market disadvantage the banks. Varieties of market types, as well as rapid and dramatic fluctuations in market prices, make market risk far more complex and difficult to forecast, assess, and mitigate. Due to unanticipated price fluctuations in a particular market, sometimes a small loss in the beginning could eventually evolve into a great loss.

Market risk management

The first step of market risk management is to determine risk tolerance. Value-at-risk (VaR) modeling is applied to measure the possibility of investment losses4. There are three methods available to mitigate market risks:

-

Diversify the asset classes and avoid putting all the investments in the same sector, which ensures that one loss in a certain area can be offset by gains in others.

-

Investments are hedged, and potential losses are minimized when the asset value falls. Hedging can be performed by purchasing put options to protect assets against the risk of price declines. The return of the investment may be lower than expected, but this approach is an appealing method for banks that do not want to take on extreme risks.

-

Staying up to the market changes and determining whether banks can afford to hold on to long-term investment, as minor changes in the market value have only temporary effects.

Operational risk

According to the BCBS (2012)5, operational risk refers to the risk originating from an internal process or information system deficiency, human error, management mistakes, or external interference. These factors may reduce, deteriorate, and disrupt the capacity of banks to provide services.

Over the decades, a growing number of banks have been exposed to operational failure, which has had a serious impact on the profitability, efficiency, and prospects of these banks. Compared with market risk and credit risk, operational risk is much more complicated, diversified, and difficult to measure and monitor due to various external and internal factors and challenges.

Operational risk management

According to Pereira and Silva (2018)6, Basel II provides three key instruments for operational risk management, namely, key risk indicators, control self-assessments, and loss data collection. Commercial banks are required to assess the exposure and frequency of operational risks in each business line and to systematically collect and analyze data on operational risk. These three instruments can help banks build processes of risk identification, evaluation, and monitoring to ensure that management can develop appropriate strategies to take control measures to achieve effective operational risk management.

Liquidity risk

Khan and Gomes (2011)7 defined liquidity risk as the risk that banks cannot fulfill their payment obligations when due. Once an individual bank cannot access adequate funding in a timely manner to satisfy great numbers of customers’ withdrawal needs, the risk of a potential run on the bank will increase, which has a negative influence on the banking sector and even the entire economic world. Liquidity risks are split into two types:

-

Funding liquidity risk occurs when banks cannot access sufficient funds in a timely manner at a reasonable cost to maintain their normal business activities and operations.

-

Market liquidity risk occurs when banks are not capable of hedging or closing open positions in financial markets without a significant or negative impact on security prices.

Liquidity risk management

To manage liquidity risk, Basel III introduced the following two independent but complementary quantitative regulatory indicators8:

-

The liquidity coverage ratio (LCR) equals the liquid assets of high quality divided by the net cash outflow within the next thirty days

9 . This approach ensures that under liquidity pressure situations, banks can hold sufficient high-quality assets without liquidity difficulties in addressing short-term risk within the next thirty days. -

The net stable funding ratio (NSFR) is a supplementary indicator of LCR that aims to encourage banks to adopt more stable and long-term financing channels and minimize the mismatch between the uses and sources of short-term funds through financing structure optimization, thereby reducing liquidity risk.

NSFR = Available stable funding/Required stable funding ≥100%

strategic risk

Strategic risk refers to the risk that banks make incorrect strategic decisions and development plans in the process of achieving their short-term and long-term business goals, which leads to reduced profitability rather than anticipated or even losses instead of profits10.

Strategic risk throughout the full lifecycle of banks will have an impact on their competitiveness because of rapidly changing environments; thus, banks should constantly reconsider and revise short-term objective and long-term development strategies to avoid the loss of market position and liquidity.

Strategic Risk Management

According to Miller (1992)11, strategic risk management steps include 1) identification and assessment of strategic risk severity, possibility, and timeliness. 2) Mapping of strategic risks. 3) Quantification of strategic risks using standard indicators, such as economic capital at risk and market value at risk. 4) Convert strategic risks to opportunities. 5) Risk-mitigating actions are planned by the risk management team. 6) Determining funding adjustment from the perspectives of funding allocation and structure.

Reputation risk

Hill (2019)12 defined reputation risk as the risk that banks are subject to losses of reputation resulting from unanticipated negative affairs, changed bank policies, and adverse events in daily operation.

In the minds of customers, banks will not incur greater losses caused by factors other than losing reputation and credibility, especially when operation systems, day-to-day businesses, and financial situations are in good condition. Moreover, restoring a bank's poor reputation will take considerable time and money.

Reputation risk Management

Since quantitative methods have not been developed to effectively manage reputation risk, the generally believed the best practice for reputation risk management is to introduce comprehensive risk management to improve corporate governance and always be prepared to prevent a crisis by effectively identifying, prioritizing, and managing reputation risks.

As per Larkin (2002)13, reputational risk management involves 1) assessing the bank’s reputation with stakeholders; 2) evaluating the banks’ real characteristics; 3) bridging the gap between reputation and reality; 4) monitoring changing anticipations and beliefs; and 5) appointing a senior officer in charge of reputational risk management.

Country risk

Country risk is defined by Bouchet and Clark (2003)14 as the risk of the counterparty’s nonfulfillment of a contractual obligation due to an unfavorable economic environment and actions taken by the government of the related country. Country risk will obviously have a great influence on the daily operation of banks in countries with unstable political and economic circumstances.

Country risk management

The most traditional country risk management measures include the enforcement of risk limits and the diversification of customers, trading counterparties, and investments. Other measures involve guarantees, financial hedging transactions, master netting agreements, and collateral15.

Systemic risk

Systemic risk is defined by Danielsson and Zigrand (2015)16 as disruption of the business process of banking services due to the breakdown of the whole financial system instead of the impairment of individual parts, which has a potentially significant adverse impact on economic growth. Thus, systemic risk refers to the failure of all components of the financial system rather than an individual institution.

Systemic risk arises in the financial system because of inherent structural weakness, such as information asymmetry, procyclicality, interdependency, and adverse incentives. Systemic risk might occur globally or simply in susceptible countries whose economies are heavily dependent on banking or whose financial institutions are primarily controlled or dominated by overseas capital.

Systemic risk management

Systemic risk management includes the following aspects17:

-

Avoid panic. The best risk management approach should focus on mitigating systemic risk from the beginning, which is achieved by preventing financial panic, which is usually the trigger that begins a series of failures.

-

Require increased disclosure. Disclosing risk is seen as a primary market regulatory mechanism that works by eliminating the asymmetry of information in market participants and makes systemic risk transparent to all parties.

-

Financial-exposure limits should be imposed. First, an institution’s leverage limitations can reduce its risk of failure. Second, restrictions on the rights of an institution for risk investment can reduce its downside risk. Third, the limitation of interinstitution financial exposure can enhance stability through risk diversification and effectively reduce contractual counterparties’ losses and the likelihood of counterparties failing as a result of such losses.

-

Limit financial institution size. This measure addresses the moral hazard problem of the financial institutions believed to be too large to fail.

-

Ensure liquidity. Stability can be enhanced by injecting liquidity into the financial institution to protect it against default, as well as into the financial market as needed to maintain its functioning.

-

Complexity Reduction. An effective method to reduce complexity is to require more standardization of financial products; thus, market players need not conduct so much due diligence.

Moral Hazard

Moral hazard is defined by Krugman (2009)18 as the concept that one person decides how much risk to take, whereas the other person accepts the consequences once things go terribly wrong, and it is the source of many financial collapses.

Banks’ strategic decision makers believe that if they make incorrect decisions and cause significant losses to their banks afterward, they will not have to directly assume the consequences, as governments and other institutions will assume these risks. Therefore, moral hazard will expose banks’ customers and investors to high levels of risk without expectation of return.

Moral Hazards Management

There are several strategies for managing moral hazards19, including the following:

-

Socioeconomic, legal, and financial environments are fostered to improve social credit system services and strengthen honest market culture.

-

To increase external regulatory competence and regulatory process transparency, optimize the externally constrained environment, and further improve the information disclosure system in the banking industry.

-

A sound internal control system, scientific risk management, and safety protection system should be built.

-

The quality and level of morality of bank staff should be enhanced, and the incentive-compatible discipline mechanism should be improved.

Whether Focusing Solely On Credit Risk Is Enough

Credit Risk Management is Necessary for Banks

Banks have the traditional principal function of lending, and other financial products are essentially the same as lending, including bonds, loans, interbank borrowings, and financial derivatives. Thus, banks must first ensure that borrowers do not default on their obligations of principal and interest repayment for survival and development; otherwise, a financial crisis will be triggered, and systemic risks will be created. One example is 2008’s global crisis or subprime mortgage crisis. This is triggered by rising interest rates and housing bubbles bursting, after which large numbers of borrowers with poor credit ratings and low incomes fail to repay the loans. After banks repossessed mortgaged properties, they could not sell collateral at normal prices and suffered considerably as a result, which led to a crisis in the entire financial system20.

During the year of the crisis, Basel I was in place only focusing on the prevention of credit risk, and it required banks to hold more capital on the balance sheet if they were exposed to more credit risk1.

Other Forms of Risk Are Also Critical to Banks

Since modern commercial banks offer various financial products in the midst of a complex financial climate, they should not only focus on credit risks but also manage other critical forms of risk.

First, Baring’s trader Nick Leeson used internal control weakness to subscribe to Japanese stock index futures worth $7 billion and purchased interest rate bonds worth $20 billion in the name of the bank without authorization; however, later, the Japanese bond market fell sharply due to the Hanshin earthquake, which caused the Barings Bank to lose more than $1 billion and declare bankruptcy. This case is an example of both operational risk and market risk, as Barings suffered from both human errors and unanticipated price fluctuations 21.

Another case is the Northern Rock Bank, which was financed mainly by other financial institutions and subsequently lent to people buying houses. Due to the subprime mortgage crisis, it was difficult to obtain funds to support Northern Rock. In September 2017, its stock price fell sharply by 70%, and there were bank runs by depositors. Although this run on banks was eased temporarily after the UK government offered to guarantee the full deposits of Northern Rock depositors, the bank’s total of £2 billion of deposits was withdrawn during this period, and it was eventually acquired by Virgin Money in 2011. This is a case of liquidity risk caused by bank runs22.

Since the implementation of Basel II, banks’ capital requirements have incorporated both market risk and operational risk. For those banks with weaker internal control and inherently higher operational risk, more capital should be held to avoid repeating the 2008 financial crisis. Basel II also uses the Value at Risk (VaR) approach to determine banks’ market risk, and future trends can be predicted using various simulation models based on historical data1.

In conclusion, other forms of risk, such as market risk and operational risk, may also seriously affect banks and result in great losses. Even worse, a financial crisis can be triggered simultaneously by interactions among different risks. Thus, more holistic approaches should be implemented to manage various forms of risk.

Over view of the Current Regulatory System

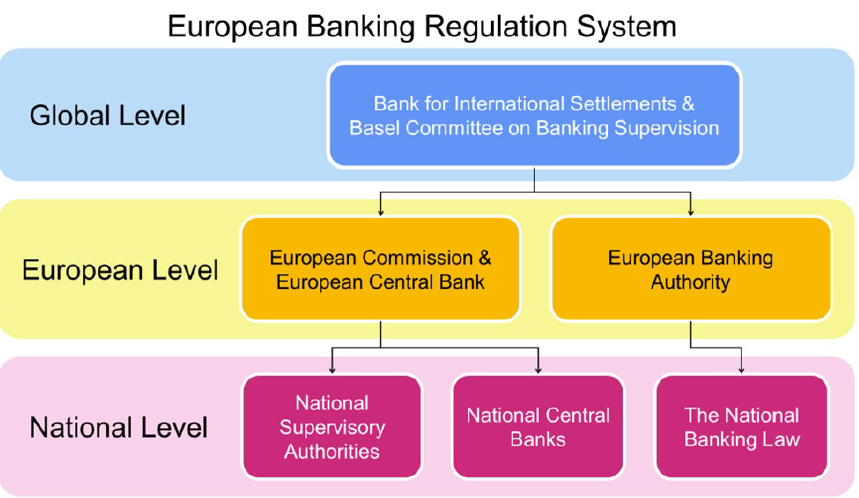

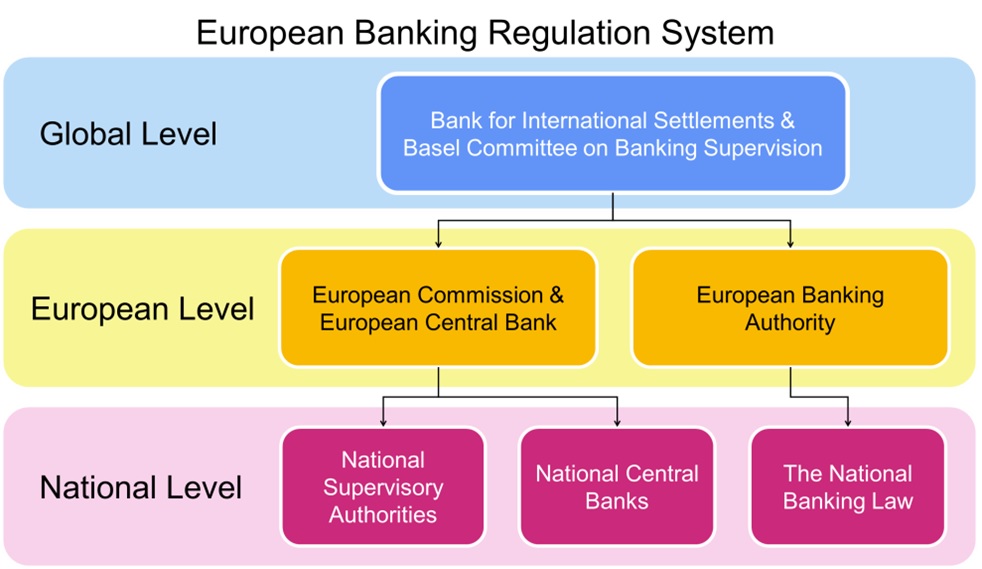

On the global level, the Basel Committee on Banking Supervision (BCBS) offers a platform of cooperation on banking regulatory affairs (exchange of regulatory information, approaches, and technology) to improve coverage and quality of international banking regulation and achieve two objectives: 1) all banks should be regulated and 2) bank regulations should be sufficient. The Basel Accord issued by the BCBS is aimed at providing regulatory standards and recommended guidelines for each country to supervise banking. As a standard regulatory framework for banks, Basel II was established in 2004 to create a globally consistent and harmonized regulatory structure as a way of ensuring a level playing field. The Basel II framework is composed of three fundamental pillars: the minimum capital requirement, the regulatory review process, and market constraints23.

The first pillar focuses on the sound and safe operation of banks. The minimum capital requirement is calculated in relation to operational risk, credit risk, and market risk in this section, with the three fundamental aspects of the regulatory capital definition, risk-weighted assets, and the minimum capital-to-risk-weighted assets ratio.

In the second pillar, the critical processes and transactions must be supervised and inspected by regulatory authorities to ensure that banks have established effective and reasonable internal assessment procedures to facilitate the identification of risk status and the assessment of capital adequacy.

Finally, the third pillar aims at disciplining banks by market forces, and the primary driving factors of the operation mechanism are stakeholder interests, such as shareholders, creditors, and depositors. Stakeholders take measures to discipline banks when necessary to protect their interests against losses.

The Basel Committee released Basel II to enhance the governance of banks, secure financial transactions, and prevent financial fraud by improving the transparency of banks’ financial statements, taxation, and capital liquidity.

On the European level, responsibility to supervise, control, and regulate banking operations is taken by the European Banking Authority (EBA) and the European Central Bank (ECB). The ECB is responsible for framing and euros, as well as implementing EU monetary and fiscal policies, with the main aim of keeping prices stable, thereby promoting economic development and job creation. The EBA regulates systemic risks, operational weakness, and institutional matters for European banks24.

On the national level, supervisory authorities together with central banks are the main national regulators, with the primary responsibility to oversee, supervise and monitor banks’ operations25. In Germany, the Federal Financial Supervisory Authority is the national regulator that supervises the banking, insurance, and securities markets. As the national central bank of Germany, the Deutsche Bundesbank works in close cooperation with BaFin and the ECB. Different countries have different national regulators to supervise banking, insurance, and financial operations 26.

The National Banking Law provides legal provisions on banking regulations related to currency issuance, supervision of banks’ credit policy, and recommendations for financial and economic issues, such as licensing, registrations, issuance and collection of cheques, trading in forex, and precious metals, and placing private or public bonds27.

Three levels of the European regulation system, and different regulators in different countries supervise banking, insurance, and financial operations. Source: Adapted from Matilainen (2014)

As illustrated in the Figure 1, there are three levels of the European regulation system, and different regulators in different countries supervise banking, insurance, and financial operations.

How to Improve the Current Regulatory System

Due to the requirements of global banking regulators and international financial institutions to establish a sound financial system, higher-quality banking regulation should be put into force to bring about a better regulatory system that can more efficiently supervise banking operations, ensure financial system stability, and increase fairness and transparency in financial markets.

Five recommendations are provided to help improve the current regulatory system:

Optimally Combine Principles-based and Rules-based Approaches

The principles-based approach is a framework in which various main principles are explicitly specified to encourage financial institutions to make voluntary efforts to comply with these principles. The rule-based approach involves the establishment of detailed rules and their application in a particular situation. The optimal combination of the above two approaches is important for ensuring the effectiveness of the overall financial regulatory system29.

Response Quickly and Effectively to Issues of High Priority

A risk-oriented, forward-looking approach is required to identify the areas of the regulatory system where potential risks exist as soon as possible and to effectively allocate proper resources to these areas to address important issues. To achieve this goal, it is necessary to monitor markets and economies to gain an understanding of banks' strategies and activities as precisely as possible through intensive communication with financial institutions and market participants.

Emphasizing the Voluntary Effort of Financial Institutions

International regulatory frameworks, including Basel III, have incorporated the approach of increasing incentive compatibility and emphasizing voluntary efforts to a considerable extent. With the current regulatory system evolving into a new phase, financial institutions' voluntary efforts have become increasingly critical, so regulators should continue to focus on the effectiveness of such frameworks.

Establish a Solid Risk Culture and Risk Appetite

Each financial institution seems to have a different risk culture and risk appetite, which is more of a qualitative rather than quantitative concept. Therefore, it is important to gain insight into the internal operations of financial institutions, which belong to the third pillar of Basel II30. However, some practices of banks are difficult to perceive if they deliberately conceal the facts. We have learned from the past that bank management has an incentive to take high risks. Although a suitable level of risk tolerance contributes to economic growth, a comprehensive understanding of banks’ risk culture is necessary for risk evaluation.

Expanding the Current Regulatory Framework to More Areas

New regulations should expand the current regulatory framework of the banking system by protecting financial transactions and banking operations security from cyber risks. Moreover, a new regulatory framework should be developed to strengthen resilience and provide greater customer data integrity, data security, and financial information confidentiality. All financial institutions should follow these new information security governance regulations to increase the effectiveness of information system management and data security.

The regulators in the banking system should also instruct banks to present their audit reports accurately and in a timely manner, including CSR, financial and risk assessment reports, to check risk management plans’ status, CSR standards, transactions, and accounts transparency31.

Conclusion

Undoubtedly, banks must face various types of risk, the main of which include market risk, credit risk, and operational risk. Banks also face other forms of risk, such as liquidity risk, strategic risk, and country risk. It is also critical for financial regulators to manage systemic risk and moral hazards.

The current regulatory system consists of the Basel Accord and national banking laws, but there is still much to be done to mitigate the risks of future global financial crises. A supranational body is required to produce harmonized regulations for the modern interconnected global economy. More holistic and practical approaches should be implemented to manage various forms of risk rather than only focusing on credit risk and regulatory capital requirements if the global financial system is smooth.

Financial regulators should combine principle-based and rule-based approaches to develop a new regulatory framework, promptly respond to high-priority issues, and emphasize the voluntary efforts of financial institutions. Given the convergence effort between regulators, auditors, and financial institutions, solid risk culture can be established, and a more holistic framework can be created by expanding into more areas, which is essential to the success of an individual bank and the soundness and safety of the entire financial system.

Acknowledgments

None.

Funding

None.

Competing interests

The authors declare that they have no competing interests.